Leap Guarantor Co-Sign Solution Deposit Solution

Articles

Most other says make it landlords to charges clients a maximum of anyplace from to 3 days’ rent. If any damages to the device past typical wear and tear try found, delight submit supporting files (i.age. pictures out of damage, invoices & receipts to possess repairs, and inspection reports) at the time of claim submission. Missed rents, problems, and you may an occupant’s failure to expend most other safeguarded costs (inside lease terms) manage all be submitted below you to definitely (1) claim and not separate claims. From the term of your lease, the fresh rental shelter deposit must be held because of the property manager and you will promptly returned to the brand new occupant if the lease involves an enthusiastic prevent. State property owner-renter laws along with influence in the event the rental shelter deposit have to be gone back to the fresh renter. It’s important for rental features citizens to save direct information, and bookkeeping to possess a rental protection deposit.

Connexus Borrowing Relationship

In the twelve months 2024, Robert’s U.S. residence can be regarded as to start to your January step one, 2024, as the Robert qualified as the a citizen inside season 2023. Ivan stumbled on the usa the very first time to the January six, 2024, to go to a business fulfilling and returned to Russia for the January ten, 2024. To the February 1, 2024, Ivan relocated to the united states and lived here to your remaining portion of the season.

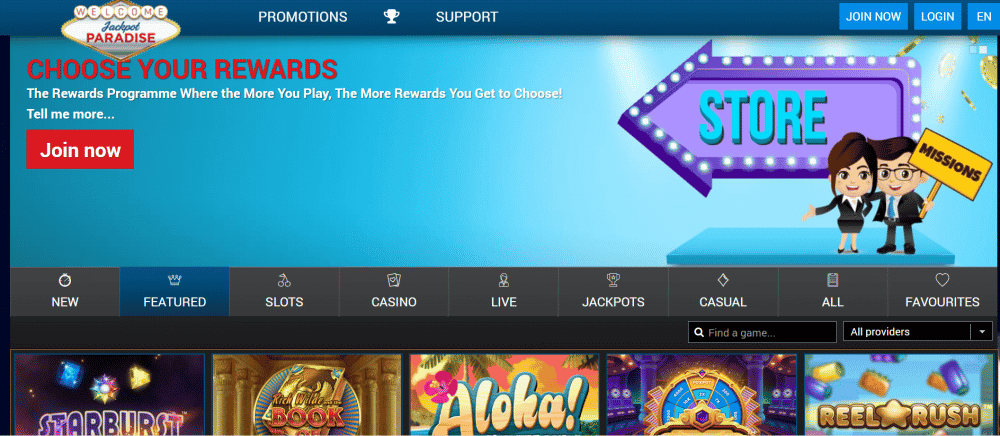

That it lowest put gambling enterprise site is acknowledged for that have a significant video game choices with many different budget gambling possibilities. They are also well liked because of the united states because of their good profile and licensing as well as a reputation looking after their people such as really. A part-year citizen are a person who try a citizen to have area of the tax season and you can a low-citizen for another area of the seasons. So it always occurs when someone alter the domicile inside nonexempt 12 months. Once you dictate the location for the finest union, you ought to know if you take the required process so you can establish an alternative domicile away from Pennsylvania. Maybe you have moved your chapel registration, car registration and rider’s permit, voter registration, bank accounts, etcetera.?

- Push leads, apartments and you will renewals when you are simplifying the newest flow-inside travel.

- You need to lose the brand new acquire otherwise losses because the efficiently linked to one trade otherwise company.

- Accordingly, the procedure takes lengthened, according to the international lender.

- You happen to be entitled to allege a lot more deductions and you will credits if the you have got a great being qualified based.

Would you Boost a protection Put?

If the range 116 and range https://blackjack-royale.com/3-minimum-deposit-casino-uk/ 117 do not equal range 115, the new FTB usually topic a newsprint take a look at. For their refund individually transferred into your family savings, complete the new account information on the web 116 and line 117. Complete the newest navigation and membership quantity and you can suggest the brand new account form of. Ensure routing and you will membership quantity together with your financial institution. See the example nearby the end of the Head Deposit of Refund instructions. Electronic money can be produced playing with Online Pay to the FTB’s site, electronic financing withdrawal (EFW) as part of the e-document go back, or their credit card.

How to submit the newest versions

If partnered/RDP processing as one, contour the degree of too much SDI (otherwise VPDI) separately for each companion/RDP. Don’t are area, local, otherwise state income tax withheld, tax withheld because of the almost every other says, or nonconsenting nonresident (NCNR) member’s tax out of Agenda K-step 1 (568), Member’s Display of cash, Deductions, Loans, etcetera., range 15e. Do not were withholding out of Mode 592-B, Citizen and you will Nonresident Withholding Income tax Statement, otherwise Setting 593, A house Withholding Report, about this line. For individuals who satisfy all requirements noted for this borrowing from the bank, you don’t need in order to be considered to utilize the head away from household processing position to have 2023 to help you allege so it credit. For reason for computing limits depending AGI, RDPs recalculate the AGI having fun with a federal pro manera Form 1040 or Setting 1040-SR, otherwise Ca RDP Modifications Worksheet (located in FTB Bar. 737).

Can i lawfully play with my personal security deposit because the past week’s book?

Properties and trusts try subject to Nyc Condition personal earnings income tax. The brand new fiduciary to own an estate otherwise believe must file Setting It-205, Fiduciary Income tax Return. While you are a nonresident otherwise area-season resident recipient out of a house otherwise faith, you must are the share of the home otherwise faith earnings, or no portion of one to earnings is derived from otherwise connected which have Ny offer, on the Setting It-203.

- The new handling of such dumps, such as the accrual interesting and its own payment, varies significantly across the states.

- Install a statement on the return to inform you the money to have the fresh part of the year you’re a citizen.

- To prevent it is possible to delays in the processing your own income tax get back or reimburse, enter the proper tax matter on this line.

- Spending bills otherwise giving finance to help you friends in the U.S. is a little bit unique of inside Canada.

- Citizens is also conveniently view and you may e-sign restoration now offers thanks to RentCafe Way of life.

Pennsylvania Local rental Guidance Software

Since the preparations with an increase of places enter force, they will be posted on this website. For additional info on around the world personal shelter plans, go to SSA.gov/international/totalization_plans.html. Resident aliens need to pay thinking-work tax beneath the exact same regulations one affect You.S. citizens. However, a citizen alien employed by a worldwide business, a different authorities, otherwise a completely had instrumentality away from a different authorities is not at the mercy of the new thinking-a job income tax for the income earned in america. Replace group are temporarily admitted to your You less than point 101(a)(15)(J) of your own Immigration and you will Nationality Work.

Nonresident Alien People

Concurrently, you can even sometimes provides maximum cash-out membership linked with certain incentives and provides. Note that talking about only linked with everything earn from the new given bonus, and when the individuals terms try removed, you are from under them immediately after the next put. This isn’t a long-term restriction on your own membership from the one mode. If one makes a deposit from simply 5 cash in the Chief Chefs Gambling establishment, you’re offered a set of 100 totally free revolves value an entire out of $25. That is played to the some of its progressive harbors, so that you score one hundred 100 percent free possibilities to unlock some large prizes.